Our Services

GXCYPX Crypto Exchange is meticulously engineered to address the most pressing calls from users and institutions worldwide: liquidity, security, usability, and regulatory alignment.

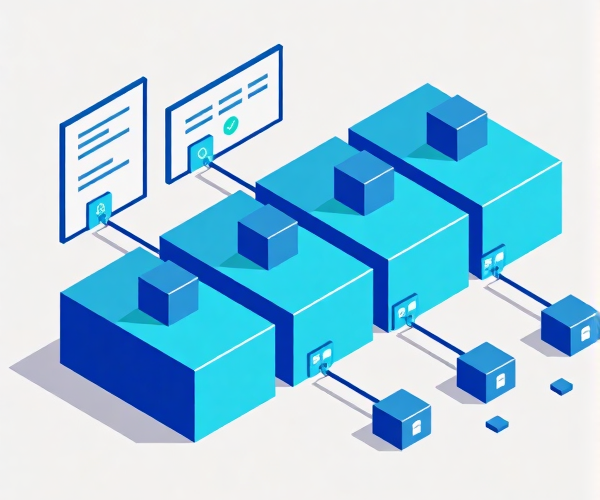

GXCYPX’s proprietary matching engine processes over 100,000 transactions per second (TPS), ensuring execution speeds under 5 milliseconds even during peak volatility.

Modular architecture enables seamless scaling as trading volume and the number of markets grow.

From simple market and limit orders to complex stop-loss and OCO (One-Cancels-the-Other), we support the trading needs of both retail and professional users.

Supports spot, futures, and OTC trading from a single account dashboard for convenient, efficient portfolio management.

Partnerships with global market makers and liquidity providers ensure narrow spreads and efficient order fulfillment, even for large-volume trades.

Supports a wide selection of fiat deposits and withdrawals (USD, EUR, BRL, etc.), facilitating frictionless access to crypto markets.

Integrated with leading Layer 1 and Layer 2 blockchain protocols—offering direct access to a diverse array of digital assets and DeFi opportunities.

98% of client assets are maintained in multi-signature cold wallets, minimizing exposure to online threats.

AI-driven monitoring detects and responds to anomalies or suspicious behaviors, with 24/7 dedicated security operations.

An open program that incentivizes white-hat hackers and security researchers to report vulnerabilities, continuously strengthening the platform.

Funds in custody are protected by cyber risk insurance, safeguarding against possible breaches.